INSURANCE

Mutual Insurance

Mutual insurers face high cost ratios and operational inefficiencies that erode profitability. HerculesAI helps you process data faster, reduce manual effort, and meet complex regulatory demands without adding headcount.

AI-Powered Efficiency for Mutual Insurers

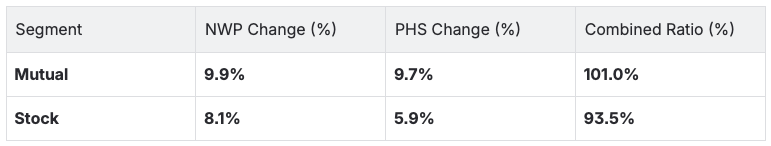

Between 2023 and 2024, mutual insurers saw stronger growth in NWP and policyholder surplus than stock companies last year—but a 101% combined ratio shows operational costs are eroding profitability.

Challenges for mutual insurers

Due to significant capital and asset bases, mutual insurers often experience higher combined ratios compared to non-mutual competitors.

Higher cost ratios

Dual processes and legacy systems create bottlenecks, slowing down policy issuance, claims handling, and premium billing.

Operational inefficiencies

Mutual insurers face increasingly strict regulations worldwide, including new financial reporting, solvency and capital rules in the EU, greater emphasis on sustainability, and stronger data protection and cybersecurity standards.

Regulatory complexity

-

Higher cost ratios: due to significant capital and asset bases, mutual insurers often experience higher combined ratios compared to non-mutual competitors.

-

Operational inefficiencies: Dual processes and legacy systems create bottlenecks, slowing down policy issuance, claims handling, and premium billing

-

Regulatory complexity: Mutual insurers face increasingly strict regulations worldwide, including new financial reporting, solvency and capital rules in the EU, greater emphasis on sustainability, and stronger data protection and cybersecurity standards.

How HerculesAI improves efficiency and competitiveness

Cut processing times from days to minutes. HerculesAI automates data ingestion, transformation, and verification across underwriting, claims, and back-office workflows.

AI-powered automation for faster time to value

This accelerates processing times, reducing manual effort and enabling mutual insurers to realize efficiency gains quickly without long implementation cycles.

Increase throughput without adding staff- free your teams to focus on high-value work

By automating repetitive, data-intensive tasks, HerculesAI helps mutual insurers do more with existing teams. Employees can focus on higher-value work, improving productivity and reducing reliance on costly staffing increases.

Streamlined regulatory compliance

HerculesAI verifies data against both external regulatory rules and internal company policies. The platform automatically flags any noncompliant items for review, so that mutual insurers maintain adherence to complex regulations while reducing manual oversight and the risk of errors.

Value from implementing AI

Accelerate customer onboarding

Streamline member eligibility checks and enrollment processing while ensuring accuracy and compliance.

-

Extract: Enrollment forms, supporting documents, and eligibility data

-

Transform: Standardize member information across systems and plans

-

Verify: Confirm eligibility criteria, coverage rules, and regulatory compliance

Result: Reduce enrollment processing time from days to hours with error reduction

Value from implementing AI

HerculesAI streamlines data intake, transformation, and verification across underwriting, claims, and finance workflows, allowing SMEs to reduce manual copy-paste tasks, accelerate renewals, and generate audit-ready data lineage. By lowering operational costs and minimizing errors, mutual insurers can improve combined ratios, narrowing the gap with stock insurers. Faster data processing also shortens cycle times for submissions, endorsements, and renewals, while robust regulatory compliance reduces risk and supports long-term business viability.

See How You Can Improve Your Combined Ratio – Book a 20-Minute Call

SAN DIEGO

Booth #914

The premier event for mutual insurers to connect, collaborate, and shape the future of the industry.

SEPT 29-30

NAMIC 130th Annual Convention

OCT 14-16

LAS VEGAS

Booth #1926

The world's largest insurtech event, bringing together innovators, carriers, and investors from across the globe.

ITC Vegas

Events

Catch HerculesAI in person at these upcoming insurance conferences and experience our solutions live. Complete the form below to reserve an in-person demo at an upcoming event or schedule an online session.